Steven McKenzieHighlands and Islands reporter

Port of Cromarty Firth

Port of Cromarty FirthA landmark agreement has been signed concluding a five-year planning process to establish a green freeport in the Highlands.

Inverness and Cromarty Firth Green Freeport (ICFGF) is expected to generate more than 11,000 jobs over the next 25 years.

It aims to become a major international hub for the offshore renewable energy sector – made up of zones where tax incentives and lower tariffs are available to companies.

The agreement was signed between the port, the UK and Scottish governments and Highland Council.

The agreement, called a memorandum of understanding (MOU), creates a formal framework for co-operation and responsibilities around the running of the port.

The signing also unlocked £25m of UK government seed funding, financial support provided to companies in their early stages, to support local infrastructure projects.

ICFGF is a partnership of private and public sector organisations, and its directors include bosses at Highland Council, University of the Highlands and Islands, SSE Renewables and Global Energy Group.

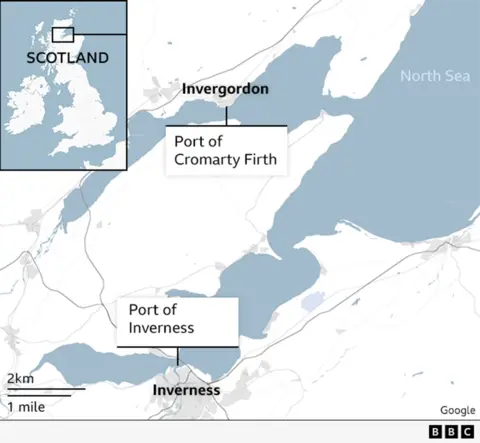

It has six main sites including Port of Cromarty Firth in Invergordon, Port of Nigg, Highland Deephaven near Evanton, and Inverness Campus.

Over the next 25 years, ICFGF said it expected to create thousands of “high-quality” jobs, many of them in the offshore wind sector.

It also said the port would attract more than £6.5bn of investment.

‘Pivotal moment’

Scottish Secretary Douglas Alexander said setting up ICFGF was a “pivotal moment” in the UK government’s mission to boost economic growth across the UK.

He said: “The freeport has the potential to show that we can transform places that benefitted from the oil and gas industry half a century ago.

“Inverness and Cromarty Green Freeport will transform the economy of the Highlands, as well as playing a key role in our clean energy future.”

Scotland’s Deputy First Minister Kate Forbes said the signing was an “exciting milestone” that could bring up to 11,300 jobs to the Highlands.

She told the BBC Radio’s Good Morning Scotland programme the freeports had been “very carefully designed” around workers rights.

She said UK and Scottish ministers had ensured such sites comply with their Fair Work First policy.

Forbes denied suggestions that green freeports were an example of “greenwashing” and said some of the guarantees secured in Scotland, particularly on fair work, were now being rolled out across the UK.

ICFGF chief executive Calum MacPherson said the port’s ambition was to deliver “positive change” for the economic prosperity of the Highlands.

Where is the Inverness and Cromarty Firth green freeport?

Port of Nigg

Port of Nigg Highland Deephaven

Highland DeephavenWhat is a green freeport?

Green freeports are places inside a country’s borders where normal tax and customs rules do not apply in full.

In Scotland, a port’s boundaries are agreed by both the Scottish and UK governments.

Green freeports contain two types of sites where the special rules apply – tax sites and customs sites.

Companies can base themselves in one or a combination of both types.

The ports also offer financial and operational incentives, including tax breaks.

In 2022, five bids were received by the Scottish and UK governments to create two of the economic zones in Scotland.

They were: Clyde Green Freeport, Aberdeen City and Peterhead Green Freeport, Opportunity Inverness and Cromarty Firth, Forth Green Freeport (FGF) and Orkney Green Freeport.

FGF and Inverness and Cromarty Firth were announced as the winning bids in September 2023.

The operators of FGF said the freeport was open for business.

They expect to receive £25m seed funding soon following UK and Scottish government approval of a full business case.

The port has an active governance board and delivery team in place.

We know there are big claims for green freeports. But how can these be achieved?

The ‘free’ name refers to the absence of tariffs in importing goods for processing.

Typically, a freeport in other countries provides a big workforce to process for a mass market, in textiles for instance.

The history of freeports and investment zones in Britain has focused on areas of industrial decline, and it’s not been a good track record, most often displacing lower-paid work from elsewhere.

This approach, in Scotland at least, focuses more on areas or sectors of opportunity and growth.

That tariff-free effect might have some impact in Scotland eventually, but it’s not the main purpose.

There aren’t many tariffs – taxes on imports – applied to the kind of goods likely to be arriving on the designated quays at Nigg, Invergordon, Ardersier and Inverness, mainly for the renewable power sector.

The big advantage there could be in reduced form-filling.

But “dumping” of low-cost steel from Asia, undercutting UK-made steel, could change that, unless the UK government takes steps to penalise such imports.

Tax incentives

The bigger impact is expected to come from tax breaks for investors and employers within the perimeter fences.

While the freeport status remains in place, which is until 2034, they don’t have to pay Land and Buildings Transaction Tax for their commercial buildings.

A development gets a five-year holiday from business rates. That is a loss to the Scottish government coffers which would normally recycle that money to Highland Council.

But the amount – potentially £400m over several years – should still be paid to the local authority by central government, to help build the infrastructure.

That means the roads and local schools, to help the freeport’s growth potential.

To ensure it’s used for the economy, the green freeport board has “strategic oversight”.

It has already been supporting development of industrial space at the Port of Nigg, the load-out quayside at Invergordon and a newly-built deepwater port for very large barges using the former fabrication yard at Ardersier.

It has backed a factory at Nigg nearing completion for manufacturing subsea cables.

A further incentive is in a three-year holiday from paying employers’ National Insurance contributions. That’s on new recruits, who have to be working on site for at least 60% of the time.

There is a risk that economic activity is sucked out of other areas because of these tax incentives.

But supply chains around the freeport hubs should be helped by more activity, including the construction industry, to build homes for the increased number of workers expected.