Faarea MasudBusiness reporter, BBC News

Getty Images

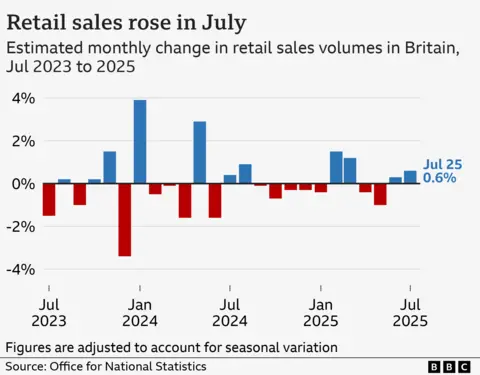

Getty ImagesSunny weather and the women’s Euro football tournament helped to lift retail sales in July, according to the latest official figures.

Retail sales volumes rose by 0.6% in July, according to the Office for National Statistics (ONS), which was more than analysts had been expecting.

Clothing and footwear stores, as well as online retailers, saw strong sales growth during the month.

The release of the figures had been delayed by two weeks over concerns about the quality of the statistics. The ONS apologised for the delay and admitted it had made errors in its seasonal adjustments to the data.

The ONS has come under fire in recent months over the reliability of some of its statistics, particularly its jobs market figures.

Its statistics are used in deciding government policy, which affects millions, and are also used by the Bank of England to make key financial decisions, such as setting interest rates.

The ONS said that while sales volumes in July rose, sales in the three months to July were down 0.6% when compared with the previous three months.

“Supermarkets, sports shops and household goods stores had a strong start to the year, but spending there has fallen since March,” said the ONS’s director general of economic statistics, James Benford.

However, he added this was partially offset by strong sales online and at clothing and footwear stores.

Mr Benford apologised for errors in past data, and said the ONS had “improvement plans” in place.

The ONS said problems with the retail sales figures meant seasonal adjustments had not been made properly. Its latest release revises most of the retail sales data for the past year.

“The new figures published today show a similar overall pattern of three-month on three-month growth, but with less volatile month-on-month changes,” Mr Benford said.

The ONS said online retailers and clothing stores saw strong sales growth in July, which retailers put down to new products, the hot weather, and an increase resulting from the UEFA Women’s Euro 2025 tournament.

“With long spells of sunshine and rising temperatures, many of us were tempted to splash out on new summer lines, updating wardrobes with flowing dresses or smart shorts that would be acceptable as office attire,” said Danni Hewson, head of financial analysis at AJ Bell.

She added that one of the successes of the “unbearably hot nights” this summer was tech and household appliances chain Currys, which on Thursday said it had seen higher demand for air conditioners and fans.

However, Paul Dales from Capital Economics warned that the boosts from the weather and the football were both factors that “won’t be repeated”.

He added that talk of tax rises ahead of November’s Budget could also hold back the sector.

Retail sales figures are watched closely as a measure of consumer spending. Increases generally mean people are spending more money, which can boost businesses and help the economy grow.

However, economists said that the revisions to the sales figures over the past few months would not affect growth estimates for the first half of the year.

Matt Swannell, chief economic adviser to economic forecaster EY ITEM Club, said the prospect for future sales growth was heavily dependent on the mood of shoppers.

“Households seem likely to shed some of the significant caution that has characterised the past couple of years,” he said.

“However, softer earnings growth, higher inflation, tighter fiscal policy, and the lagged impact of past interest rate rises for some mortgagors point to much weaker real income growth moving forward.”