BBC business reporter

Getty Images

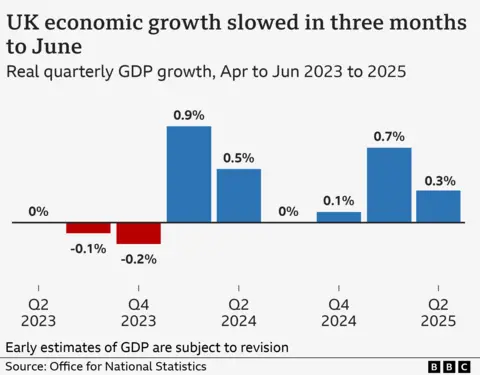

Getty ImagesUK economic growth slowed between April and June, according to official figures, but came in better than expected.

The economy expanded by 0.3%, down from 0.7% in the first three months of the year, the Office for National Statistics said.

The biggest contribution came from services while the construction industry also grew.

The government has made boosting economic growth a key priority and the latest data beat forecasts of 0.1% expansion, which would have been near stagnation.

Chancellor Rachel Reeves said the figures “beat expectations” but added there was “still more to do” so people in all parts of the country benefit from growth.

The economy performed better than expected in June, and the ONS also revised up figures for April – instead of shrinking by 0.3%, it now said the economy contracted by 0.1%.

Experts suggested that hot, dry weather helped lift activity in the construction industry, which expanded by 1.2% in the three months to June.

In the services sector, computer programming including consultancy, software installation and disaster recovery helped push up growth.

Vehicle rentals and health services such as doctors’ surgeries, hospitals and nursing homes also boosted the economy.

Retailing dragged on growth over the period but picked up towards the end.

Compared with other members of the G7 – the world’s richest nations – the UK economy grew the fastest in the first three months of the year, but not the second.

However, taken together, the UK may have had the fastest growth in the first half of 2025.

The resilience of the UK economy may prompt the Bank of England to be more reluctant about cutting interest rates, said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

She said policymakers may choose to hold off until inflation begins heading back to the Bank of England’s 2% target.

Last week, the Bank raised its inflation forecasts and now expects the pace of price rises to peak at 4% later this year before receding to the target in 2027.

But Ruth Gregory, deputy chief UK economist at Capital Economics, said it was doubtful the country “will maintain this pace of growth” between July and September.

“The weak global economy will remain a drag on UK growth for a while yet,” she said.

“The full drag on business investment from April’s tax rises has yet to be felt. And the ongoing speculation about further tax rises in the Autumn Budget will probably keep consumers in a cautious mood.”

Earlier this month, the National Institute of Economic and Social Research think tank said taxes would have to rise in the autumn if Reeves wants to meet her self-imposed borrowing rules and avoid missing a target the government has set itself by £41.2bn.

Figures from the ONS showed that business investment fell sharply, down 4%, compared with growth of 3.9% in the first three months of the year. Household spending also dipped.

‘Unexpected sunshine’

Iain Hoskins, who owns several venues in Liverpool, said he was “very worried” after the last Budget, with increased National Insurance Contributions adding £100,000 to his costs.

However, he said he was “feeling more positive than we have done for the last few years,” thanks largely to better weather and consumer confidence.

“The quarter that we are talking about, we had a very early summer and often that period can be a complete washout,” he said. “Unexpected sunshine really did bring people out in force.

“Interest rates going down has really helped: more money in peoples’ pockets. That is fundamental.”

The Bank of England has cut interest rates five times over the past 12 months, taking borrowing to 4%.

Goldman Sachs, the US investment bank, lifted its forecast for UK annual growth from 1.2% to 1.4%.

The chancellor said the economy “has been stuck for too long”.

“We are trying to get it out of the rut of the last few years with anaemic growth, poor productivity and living standards going backwards,” she said.

However, Conservative shadow chancellor Mel Stride accused her of “economic vandalism” while Liberal Democrat Treasury spokeswoman Daisy Cooper said: “Snails would scoff at the pace that our economy is growing.

“The Conservative Party led us into this economic quagmire but this Labour government has failed to break from the years of mismanagement.”

Trump trade

James Smith, an economist at ING Bank, told the BBC’s Today programme that the figure for the April-to-June period was “not bad”.

In the first three months of the year, economic growth was “boosted by firms trying to get ahead of Donald Trump’s tariffs”, he said, as well as homebuyers rushing to complete before a change in stamp duty thresholds in April.

“Those factors were always going to be a drag, so the fact that we’ve ended up with 0.3% growth in an environment of global uncertainty isn’t really a bad result,” he said.

Separate trade figures on Thursday showed British goods exports to the US dropped to their lowest level in more than three years in June due to Trump’s tariffs.